Financial statements are like your business’s financial report cards. They provide valuable information that goes beyond just numbers, helping you make informed decisions for your business. In this guide, we’ll dive into the three most important financial statements: the balance sheet, income statement, and statement of cash flows. By the end, you’ll have a good understanding of how these statements work together to guide your business toward its goals. Lets dive in.

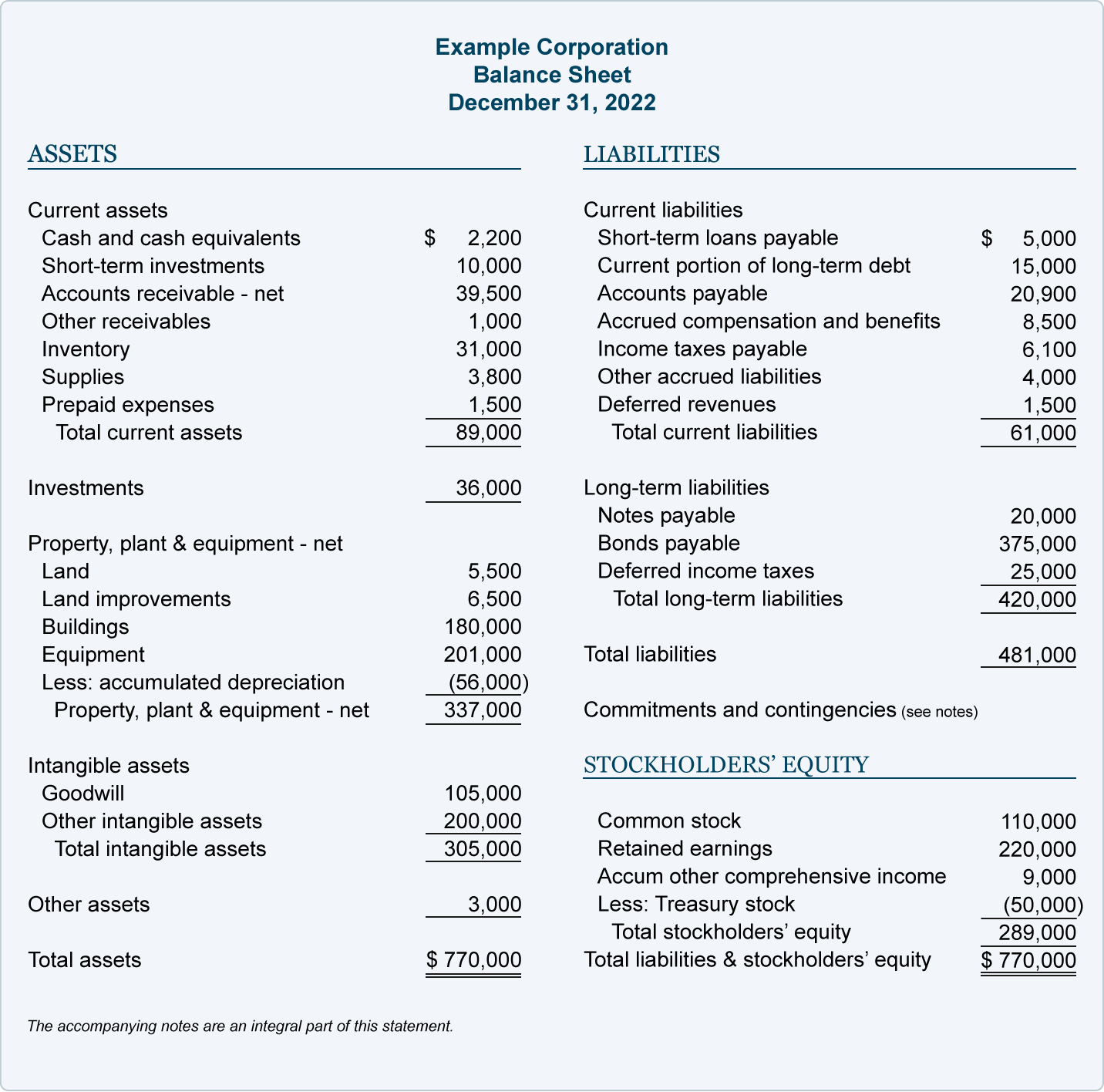

The Balance Sheet:

Think of the balance sheet as a look into your business’s finances at a certain point of time. It shows what you own (assets), what you owe (liabilities), and what’s left for you (equity). This statement is crucial for business owners and stakeholders looking to assess the financial health of a company.

Now, let’s break down the balance sheet equation: Assets = Liabilities + Equity.

Assets: These are things your business owns, like cash, equipment, or even patents.

Liabilities: These are debts or things you owe, like loans or unpaid bills.

Equity: Equity is what’s left after you subtract what you owe from what you own. It’s like a reward for business owners. Understanding equity tells you how well your business is doing financially.

The balance sheet serves as a snapshot of your business’s financial position at a specific moment in time, revealing the connection between assets, liabilities, and equity. By grasping the different sections of the balance sheet, you gain valuable insights into the components that drive your business’s financial well-being. The balance sheet is a core part to guiding you toward informed decisions and a deeper understanding of your business’s financial success.

Balance Sheet example:

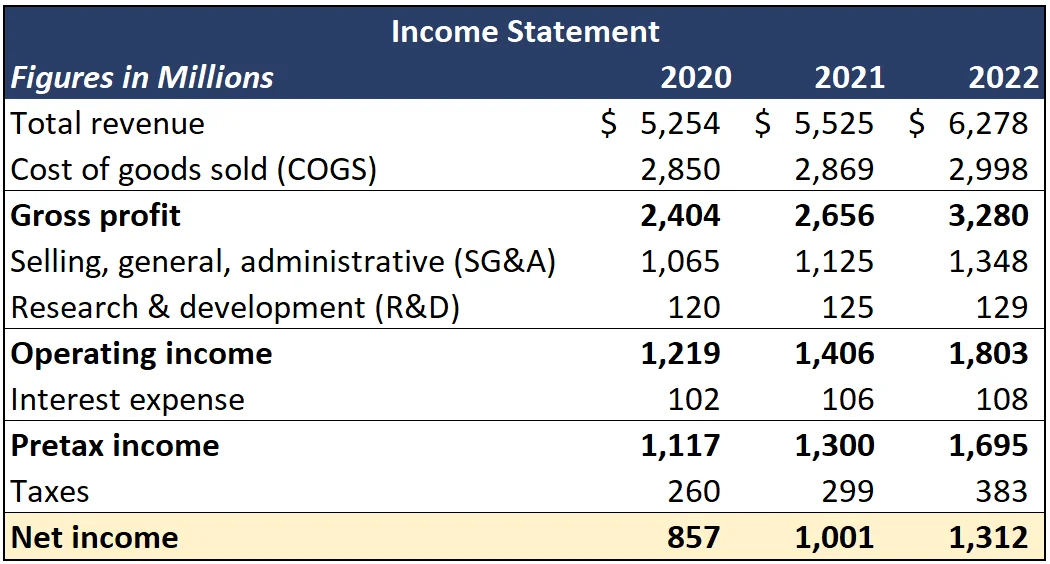

The Income Statement:

The income statement, also recognized as the profit and loss (P&L) statement, is like a money story. It tells you how much money you made, how much you spent, and if you made a profit or a loss during a certain time. Here are the key parts:

Revenue: This is the total money your business earned from selling products or services.

Cost of Goods Sold (COGS): It’s the money you spent to make the products you sell.

Gross Profit: This is what’s left after you subtract COGS from your revenue. It shows if your products or services are profitable.

Operating Expenses: These are costs of running your business, like rent, wages, and advertising.

Net Profit: This is your bottom line. It’s what’s left after you subtract all your expenses from your revenue. It’s the money your business keeps.

Unlike the balance sheet, which offers a fixed perspective, the income statement tracks changes over a time period. This allows business owners or stakeholders to see how effectively a company is generating profits and managing expenses. You now have the ability to better plan ahead as you have a complete view of your revenues and expenses and how they may vary per month or year.

Income Statement example:

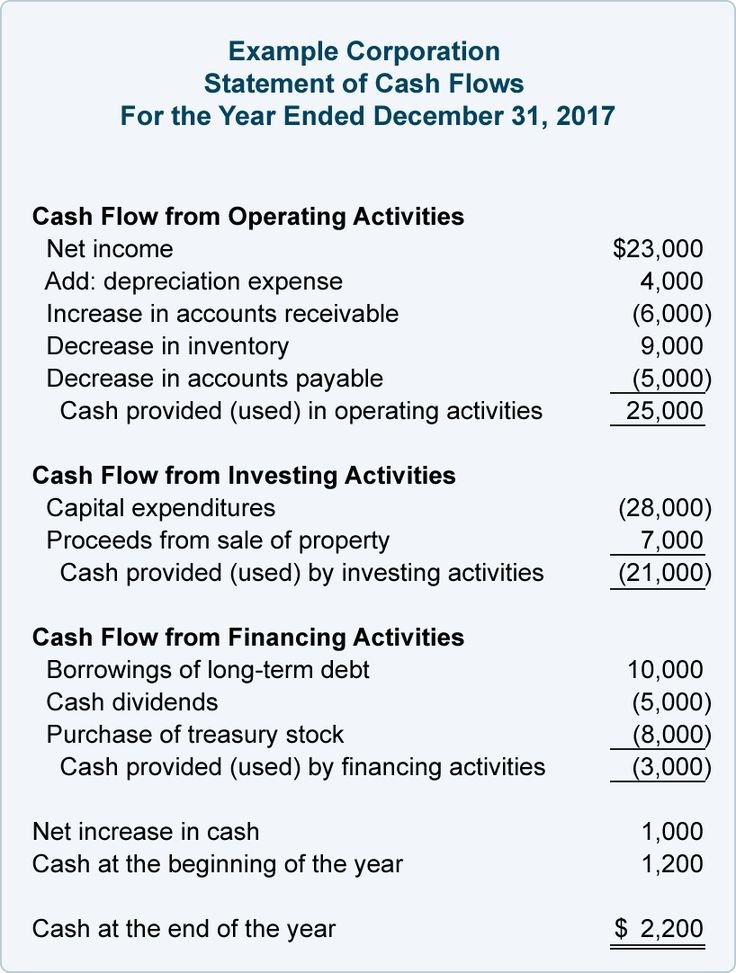

Statement of Cash Flows:

A statement of cash flows is a financial document that tracks the inflow and outflow of cash within a business over a specific period of time, typically a month, quarter, or year. It provides a detailed breakdown of how cash is generated and used in the company’s operations, investments, and financing activities. The statement of cash flows is broken into three parts:

Cash Flows from Operations: This is the cash inflows and outflows from your regular business activities. It includes cash received from customers, payments to suppliers and employees salaries. This can indicate how well a company manages its day to day operations to generate cash.

Cash Flow from Investing Activities: This is money typically spent on long term assets. These activities can involve buying or selling property and equipment or the purchase of stocks or securities. Cashflows from investing activities can show how a company is investing in it’s future growth.

Cash Flow from Financing Activities: Here, you see money you got from obtaining loans, issuing stock or paying dividends to shareholders. This part reflects how the company raises capital and how it returns capital to its investors.

The statement of cash flows is a crucial financial tool because it helps business owners and investors understand how a company manages its cash resources. It also assists in assessing a company’s liquidity, financial stability, and ability to fund its operations and growth.

Statement of Cash Flows example:

Using Financial Statements Wisely:

In a nutshell, financial statements are more than just boring papers – they’re your secret weapon to making good choices for your business. By getting the hang of the balance sheet, income statement, and statement of cash flows, you’ll be on your way to financial success.

Think of financial statements as a constant source of information that guides your financial choices and supports your business growth. Whether you’re a business owner, investor, or lender, these statements are your best pals for unlocking your business’s full potential.